Introduction: NABARD Loan for Dairy Farming – Atul’s Success Story

According to the NABARD report, dairy farming can be a profitable business in India, but to achieve this, financial support is required, i.e., money. My friend Atul, who is successful in his dairy farm, expanded his business with the help of the NABARD Loan for Dairy Farming. Atul modernized his farm through low-interest rates and government subsidies, and today, he is earning a profit of Rs 1 to 2 lakh/month from his dairy business.

Atul’s story proves that dairy farming can be profitable with the right financial planning and support. If you also want to grow your dairy farm, then an NABARD loan can be an effective solution.

In this blog, we will tell you about the benefits of NABARD Dairy Loan, the application process, subsidies, and how it will help you grow your business.

What is NABARD Dairy Loan 2025?

NABARD Dairy Loan 2025 is a government-backed financial scheme that provides loans at low interest rates to dairy farmers to expand and modernize their farming operations. The primary aim of NABARD (National Bank for Agriculture and Rural Development) is to promote rural development and agriculture, and the focus of this loan scheme is to make dairy farming sustainable and profitable.

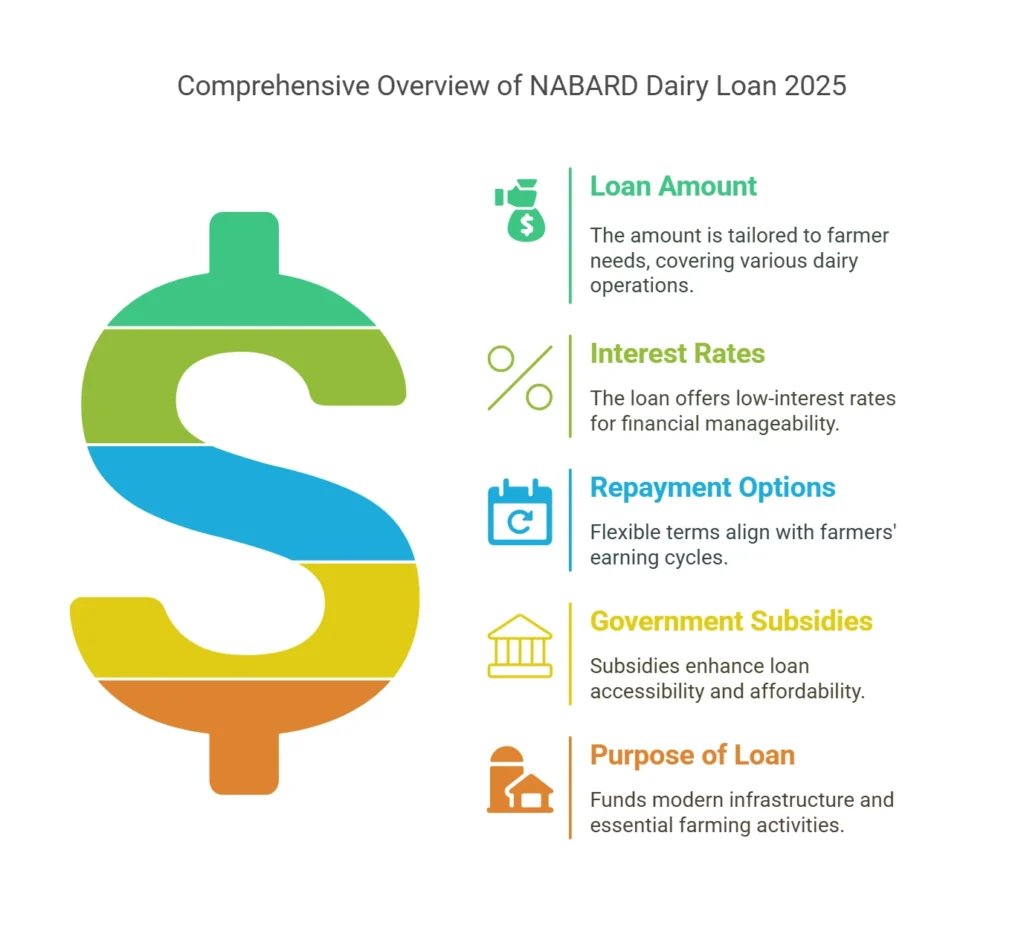

Key Features of NABARD Dairy Loan 2025:

Nabard dairy loan scheme 2025

The NABARD Dairy Loan Scheme 2025 provides comprehensive financial support specially designed for dairy farmers. This loan scheme provides essential funding to farmers to expand and modernize their dairy operations. Under this scheme, farmers get flexibility in loan amount, interest rates, and repayment terms. Here are the top schemes in 2025

Dairy Farm NABARD Subsidy 2025

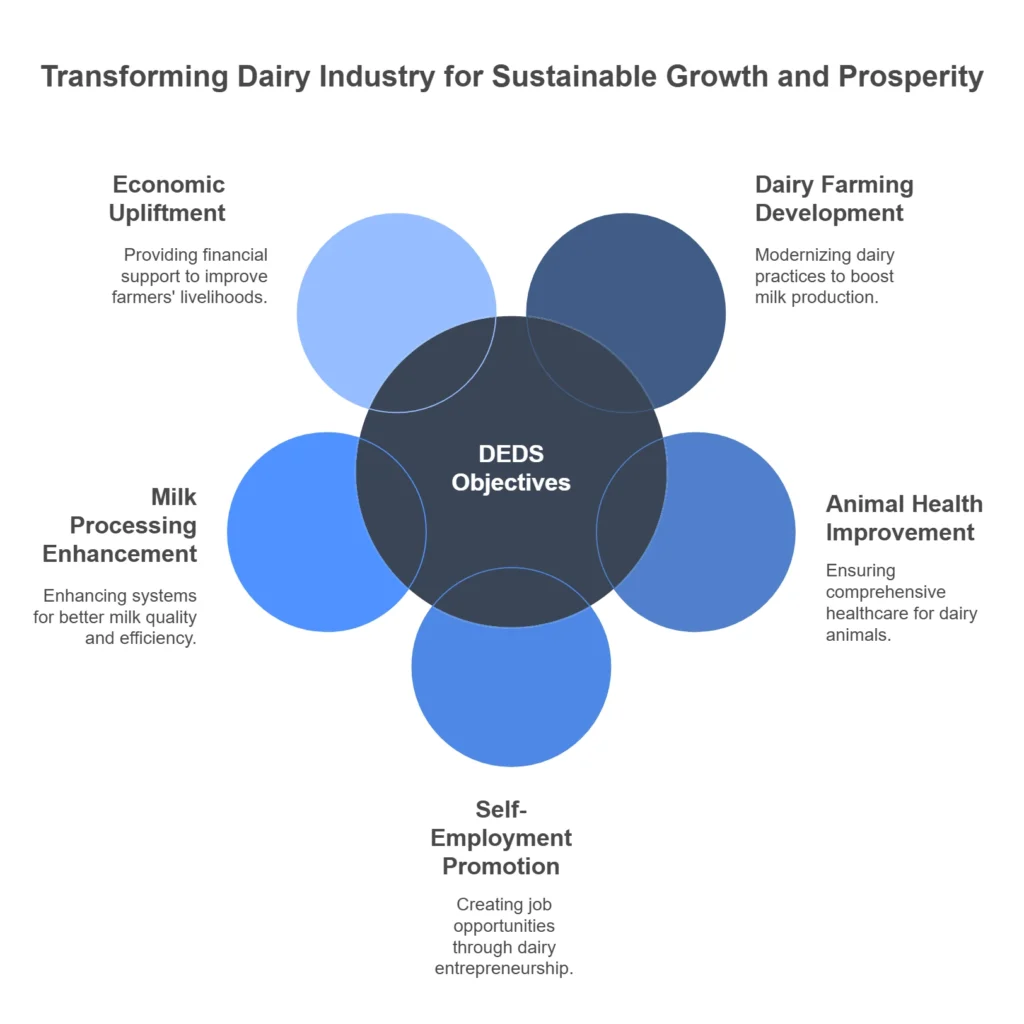

Dairy Entrepreneurship Development Scheme (DEDS)

The Dairy Entrepreneurship Development Scheme (DEDS) is a scheme launched by the Indian government to promote the small and medium dairy industry and provide self-employment opportunities. Its main objective is to improve milk production, improve it commercially, and bring economic improvement through executive management.

5 Main Objectives of DEDS

Eligible Activities for DEDS

✓ Buying 2-10 milch animals

✓ Setting up small processing units

✓ Milk-chilling equipment

Subsidy Structure for DEDS

How Farmers Can Apply for DEDS

Get Information: Visit your local agricultural department or NABARD office to gather all the necessary information about the DEDS scheme.

Select Eligible Activities: Choose the appropriate activities based on your dairy farm size and business plan.

Fill out the Application Form: Complete the application form with details about your business plan, financial status, and project requirements.

Submit the Application: Submit the completed application form to your regional agricultural department or NABARD office.

Approval and Assistance: Upon approval, you will receive financial assistance and subsidies as per the scheme’s guidelines.

Dairy Processing & Infrastructure Fund (DIDF)

The Dairy Processing & Infrastructure Fund (DIDF) is designed to improve and modernize the infrastructure of the dairy sector in India. It aims to help dairy farmers and businesses boost milk production, improve quality, and expand processing capacities. The goal is to create a more efficient and sustainable dairy industry that can meet both domestic and international demand.

Key Objectives of DIDF

Who Should Apply?

Dairy cooperatives

Private processors (turnover of ₹50Cr+)

FPOs with 100+ members

Subsidy Structure for DIDF

How Farmers Can Apply for DIDF

Check Eligibility: Visit NABARD or the agricultural department for details.

Create a Business Plan: Outline how you will use the funds to improve dairy processing.

Submit Application: Complete and submit the application with your plan.

Approval: Once approved, you’ll receive funding to upgrade your dairy infrastructure.

DIDF is a great opportunity for dairy entrepreneurs to modernize their operations, improve product quality, and expand their businesses.

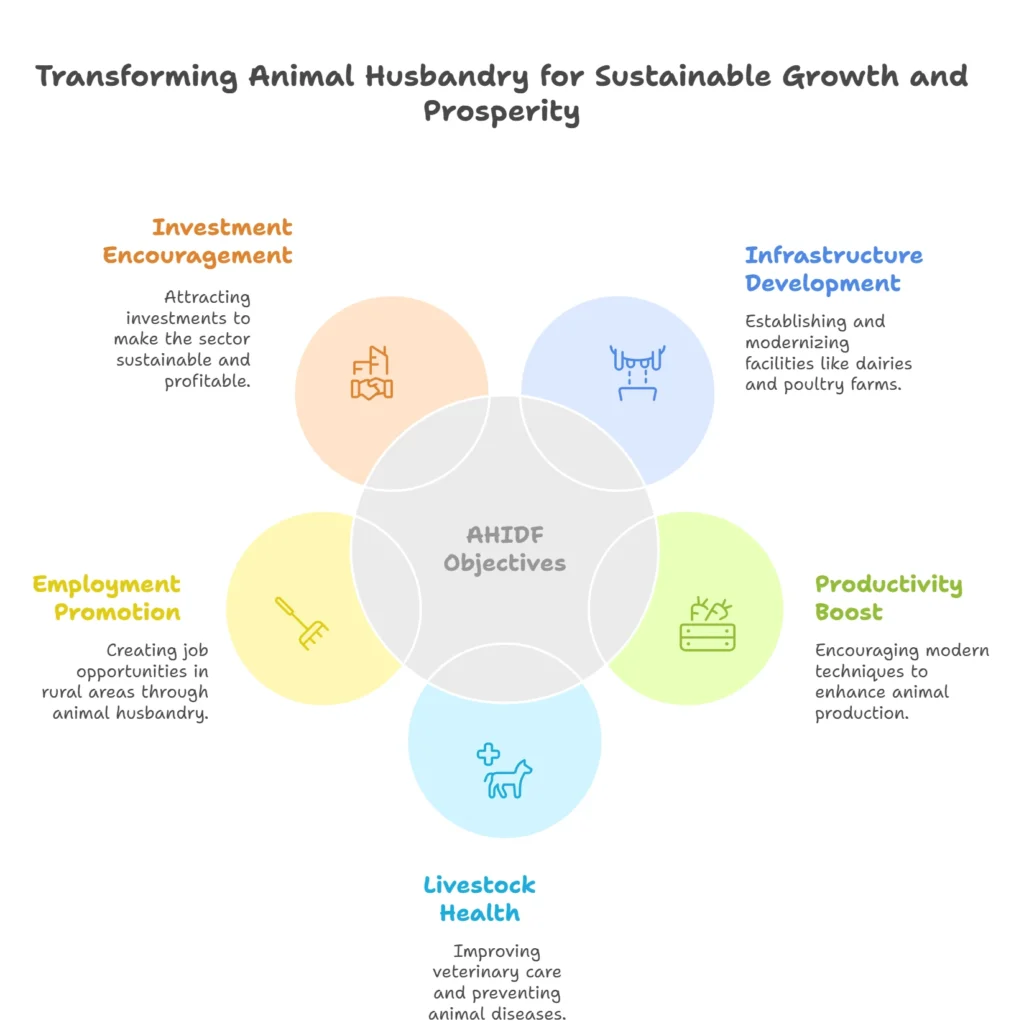

Animal Husbandry Infra Fund (AHIDF)

The Animal Husbandry Infrastructure Development Fund (AHIDF) is an initiative launched by the Government of India to boost the animal husbandry sector. It provides financial support for setting up and upgrading infrastructure in areas like dairy, poultry, and meat processing.

Key Objectives of AHIDF

Subsidy Structure for AHIDF

How Farmers Can Apply for AHIDF

Research and Check Eligibility: Farmers and entrepreneurs can visit NABARD or the Ministry of Animal Husbandry to learn about eligibility and requirements for AHIDF.

Prepare a Business Plan: Create a solid business plan detailing how the funds will be used to enhance infrastructure in the animal husbandry sector.

Submit Application: Complete the AHIDF application and submit it along with the necessary documents, such as the business plan and proof of eligibility.

Evaluation and Approval: The application will be evaluated, and upon approval, the funding will be disbursed for infrastructure development.

Utilize Funds: Once approved, farmers and entrepreneurs can use the funds to set up or upgrade their animal husbandry infrastructure, improving their business operations.

Comparison In DEDS, DIDF, AHIDF

Other Dairy farming loan schemes For 2025

1. National Dairy Development Board (NDDB) Schemes

2. Rashtriya Krishi Vikas Yojana (RKVY)

3. Pradhan Mantri Krishi Sinchayee Yojana (PMKSY)

4. Kisan Credit Card (KCC) Scheme

5. PM GDISHA – Pradhan Mantri Gramin Digital Saksharta Abhiyan

Types of NABARD Loans for Dairy Farming

NABARD provides various loan options for dairy farmers to support their business, whether they are starting a new dairy farm, expanding existing operations, or investing in milk processing and infrastructure. Here’s a detailed look at the different NABARD loan schemes available:

NABARD Loan for Cow and Buffalo Farming 2025

Eligibility Criteria for NABARD Dairy Loan (Cow & Buffalo Farming)

Documents Required for Cow and Buffalo Loan 2025

Nabard Loan Interest Rate 2025

How to apply Nabard loan for dairy farming 2025

Starting a dairy farm but worried about funding? NABARD (National Bank for Agriculture and Rural Development) offers special loans with low interest rates and subsidies to help farmers like you! Whether you’re a beginner or expanding your existing farm, this simple, human-friendly guide will walk you through the entire 2025 application process.

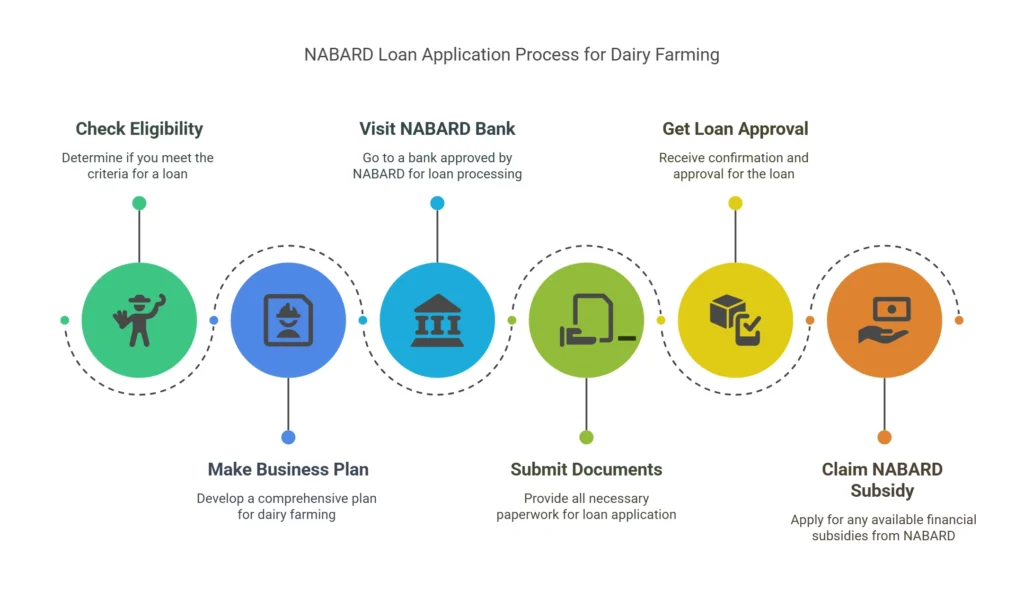

How to Apply for NABARD Loan for Dairy Farming in 2025: Step-by-Step Guide

Step 1: Understand Whether You’re Eligible

Before you rush to the bank, you need to check if you meet the eligibility criteria. Here’s a simple checklist:

✔ Who can apply? – Farmers, dairy cooperatives, SHGs (Self-Help Groups), FPOs (Farmer Producer Organizations), or even individuals who want to start a dairy farm.

✔ Minimum age? – You must be at least 18 years old.

✔ Land requirement? – If you own land, that’s great! But even if you don’t, you can lease land and still apply.

✔ Credit score? – While not strictly required, a good financial history helps in loan approval.

Step 2: Prepare Your Dairy Farm Business Plan

Now, this part is important. The bank won’t just give you money without knowing how you’ll use it. You need to prepare a business plan that includes:

📌 How many cows or buffaloes you plan to buy

📌 Estimated milk production and earnings

📌 Cost of fodder, farm setup, and equipment

📌 Your plan for repaying the loan

👉 Tip: If you’re not sure how to make a business plan, you can get help from Krishi Vigyan Kendra (KVK) or NABARD consultants in your area.

Step 3: Visit the Nearest NABARD-Approved Bank

Once your business plan is ready, the next step is to visit a bank that offers NABARD dairy loans. You can apply through:

🏦 State Bank of India (SBI), PNB, Canara Bank, ICICI, HDFC, Axis Bank, Regional Rural Banks (RRBs), and Cooperative Banks.

💡 Tip: It’s best to visit 2-3 banks and compare their interest rates and loan terms before finalizing one. but SBI is my favorite bank for dairy loan

Step 3: Visit the Nearest NABARD-Approved Bank

Here’s what you’ll need to apply:

📝 NABARD loan application form (available at the bank)

📜 Identity proof – Aadhaar card, PAN card

🏡 Address proof – Electricity bill, Ration card

🏞 Land documents— If you own/lease land

📊 Bank account statement – Last 6 months

📈 Dairy farm business plan

👉 Once you submit everything, the bank will verify your details and process your application.

Step 5: Wait for Loan Approval & Disbursement

The bank will review your business plan and documents. If everything looks good, your loan will be approved within 15-30 days. The money will be directly credited to your bank account or sometimes paid to vendors/suppliers for buying cows, buffaloes, or equipment.

💡 Tip: Stay in touch with the bank official handling your case. A little follow-up can speed up the process!

Step 6: Dairy Farm NABARD Subsidy 2025

Now comes the best part—getting a subsidy!

Once your dairy farm is set up and running, you can apply for a subsidy from NABARD. Some key schemes include:

✅ Dairy Entrepreneurship Development Scheme (DEDS) – Up to 25-33% subsidy on loans.

✅ Animal Husbandry Infrastructure Fund (AHIDF) – Covers up to 50% of project cost.

✅ Dairy Processing & Infrastructure Development Fund (DIDF) – Provides low-interest loans.

📌 Tip: Ask your bank about the exact subsidy amount you can avail yourself of, as it varies based on your category (General, SC/ST, Women, SHGs).

💡 Tips to Increase Loan Approval Chances

✔ Start Small: Apply for 5-10 cows first (easier approval)

✔ Clear Credit History: No pending loans or defaults

✔ Government Tie-ups: Cooperatives get faster approvals

✔ Insurance: Insure cows for better loan terms

🆕 Latest Updates on NABARD Dairy Loan Apply Online (2025)

1. Online Application Now Available through Major Banks

In 2025, applying for a NABARD Dairy Loan has become easier with the support of various leading banks like SBI, Bank of Baroda, and Central Bank of India offering online application portals. For instance, SBI’s YONO Krishi – Safal Dairy Loan allows farmers to apply directly from their smartphones without visiting the bank.

2. Bank of Baroda’s New Scheme for Mini Dairy Units

| Particular | Details |

|---|---|

| Loan Amount | ₹60,000 to ₹600,000 |

| Repayment Tenure | Up to 5 Years |

| Purpose | Small-scale dairy farming |

3. Updated Interest Rates & Subsidy Info (2025)

As of 2025, NABARD Dairy Loan interest rates start from 8.05%, depending on the bank and credit profile. Subsidies are still provided under various schemes such as:

Dairy Entrepreneurship Development Scheme (DEDS)

Animal Husbandry Infrastructure Development Fund (AHIDF)

Dairy Processing and Infrastructure Development Fund (DIDF)

4. Documents Required for Online Application

If you’re applying for a NABARD Dairy Loan online, here are the key documents required:

| Document Type | Examples |

|---|---|

| ID Proof | Aadhar Card, PAN Card |

| Address Proof | Electricity Bill, Ration Card |

| Bank Details | Last 6-month statement |

| Project Report | Dairy business plan |

| Land Proof | Ownership or lease agreement |

Nabard dairy loan apply online 2025

If you want to start or expand your dairy farming business, NABARD Dairy Loan can provide the necessary financial support. You can now apply for this loan online with ease. Follow this step-by-step guide to understand the process

How to Apply for NABARD Dairy Loan Online 2025

Can You Apply for NABARD Dairy Loan Fully Online?

Currently, NABARD doesn’t offer direct online applications, but you can complete 80% of the process digitally through partner banks. Here’s how

Step-by-Step Online Application Process For Nabard Loan

1. Preliminary Steps (Online)

Check Eligibility at NABARD’s E-Shakti Portal

Calculate the Loan Amount using NABARD’s Dairy Project Calculator

Download the Application Form from your preferred bank’s website (SBI, PNB, etc.)

2. Document Preparation (Digital)

Scan these documents in PDF/JPG format:

Aadhaar & PAN card

Land documents (ownership/lease)

Detailed Project Report (DPR) – [Download Template]

6 months bank statements

Breed selection quotations

3. Online Submission Options

| Bank | Online Process | Portal Link |

|---|---|---|

| SBI | Partial online submission | SBI Agri Loans |

| PNB | DPR upload + appointment booking | PNB Kisan |

| NABARD-Approved RRBs | Varies by regional bank | Check the local RRB website |

Note: After online submission, physical verification is mandatory.

Alternative: NABARD’s E-Shakti Portal

While not for direct loans, this portal helps:

Check subsidy eligibility

Find approved consultants

Track application status

Access training materials

Complete Online-Offline Process Flow

Online: Submit initial form + documents

Offline: A Bank representative visits your farm

Online: Track application status

Offline: Final approval & disbursement

Success Stories of Dairy Farmers in India

1. Atul Sharma – From a Small Farmer to a Dairy Entrepreneur (Madhya Pradesh)

Atul Sharma, a young farmer from Madhya Pradesh, started his dairy farm with just 5 cows. Due to financial struggles, he couldn’t expand his business. That’s when he learned about the NABARD Dairy Entrepreneurship Development Scheme (DEDS) and applied for a loan of ₹10 lakh.

✔ How NABARD Helped?

He received a 25% subsidy (₹2.5 lakh) on the loan.

Used funds to buy 15 more cows and set up a milk processing unit.

Today, he supplies over 300 liters of milk daily to local markets and earns ₹1.5 lakh per month.

💡 Atul’s Advice: “Government schemes are very helpful. If you plan well and use NABARD subsidies, dairy farming can be a very profitable business.”

2. Pooja Devi—A Woman Entrepreneur’s Dairy Revolution (Haryana)

Pooja Devi, from a rural village in Haryana, struggled to support her family. She always dreamed of having her own dairy farm but lacked funds. She applied for an Animal Husbandry Infrastructure Fund (AHIDF) loan and started with 10 Murrah buffaloes.

✔ How NABARD Helped?

A 50% subsidy on dairy equipment helped her install a bulk milk cooler and automatic milking machines.

She expanded her farm to 40 buffaloes and now earns ₹2 lakh per month by supplying milk to major dairy brands.

💡 Pooja’s Message: “Women can also succeed in dairy farming. NABARD schemes have given me financial independence.”

3. Ramesh Patel – Modern Dairy Farm with NABARD Support (Gujarat)

Rmesh Patel, a progressive farmer from Gujarat, wanted to start an organic dairy farm but lacked financial support. He applied for a ₹15 lakh loan under the Dairy Processing & Infrastructure Development Fund (DIDF).

✔ How NABARD Helped?

He got a 6.5% low-interest loan to set up a modern dairy farm with 50 cows.

Installed solar-powered milk chilling units using government subsidies.

Now, he sells organic A2 milk directly to consumers and earns ₹3 lakh per month.

💡 Ramesh’s Key Learning: “Technology and subsidies can take dairy farming to the next level. Plan wisely and use government schemes.”

Click to Join Our Free WhatsApp Group and YouTube for Agriculture Updates!

Get daily updates, free study material, and the latest schemes, and connect with other agriculture students and farmers.

Common questions

NABARD Dairy Farming Loan Scheme is a government-backed financing initiative that provides low-interest loans with subsidies to farmers, entrepreneurs, and cooperatives for:

Starting new dairy farms 🐄

Purchasing high-yield cattle (cows/buffaloes)

Building sheds & infrastructure

Installing milk processing/chilling units

Key Features:

✔ Interest Rates: As low as 4-7% (with subsidies)

✔ Loan Amount: Up to ₹10 lakh (individuals) | ₹100 crore (for large projects)

✔ Repayment: 5-10 years (with 6-12 months moratorium)

✔ Subsidy: 25-33% of project cost

Top Schemes:

DEDS (For small farmers)

DIDF (For processing units)

AHIDF (For infrastructure development)

Example: A farmer with 5 cows can get a ₹5 lakh loan + 33% subsidy under DEDS.

For the latest 2024-25 guidelines: Visit NABARD’s Official Website

NABARD does not offer completely interest-free loans, but farmers can get near-zero effective interest through:

Subsidy Schemes (25-33% capital subsidy)

Interest Subvention (2.5-3% reduction)

State Govt. Top-Up Schemes

Up to ₹10 lakh for individuals (₹50 lakh for groups) under the DEDS scheme. Large projects can get ₹100 crore under DIDF.

4-7% for DEDS, 6-9% for other schemes (with an an additional 2.5-3% interest subvention).

Yes, with a valid 7+ year lease agreement.

Yes! Average ROI 20-25% with proper management.

🚀 Conclusion: NABARD Loan for Dairy Farming—Your Gateway to Success!

The NABARD Loan for Dairy Farming program has emerged as a transformative financial solution for Indian farmers and agri-entrepreneurs. Whether you’re

A small-scale farmer starting with 2-5 cows

A women’s SHG looking to establish a milk processing unit

An existing dairy farmer planning to expand operations

The NABARD Loan for Dairy Farming offers unbeatable benefits with subsidized interest rates (as low as 4-7%) and government subsidies up to 33%, making dairy entrepreneurship accessible to all.

Why Apply Now?

✔ Special subsidy benefits are available until April 2025

✔ Long repayment tenure (up to 10 years)

✔ End-to-end support, including training and market linkages

Your Next Steps:

1️⃣ Contact a NABARD-approved bank (SBI, PNB, RRBs)

2️⃣ . Prepare a Detailed Project Report (Download our free template!)

3️⃣ Apply for NABARD Loan for Dairy Farming and claim your subsidy

📢 Remember:

“Thousands of farmers have transformed their lives through NABARD Loan for Dairy Farming—now it’s your turn!”

Got questions? Ask in the comments—we’re happy to help! 🐄💙

Other agriculture loans apply 2025

Related post

Hydroponic Farming Cost: A Complete Guide for Farmers and Agriculture Students

Hydroponic Farming Cost Hydroponic farming is an advanced, soil-less cultivation...

Read MoreGoat Farming Loan: A Complete Guide to Financing Your Goat Farm in 2025

Goat farming is a fast-growing livestock business in India, which...

Read More🐐 Goat Farming Project Report 2025 – Practical Updates Every New Farmer Must Know (Cost, Profit Analysis)

If you’re searching for a low-investment, high-return agribusiness, goat farming...

Read MoreAdvantages and Disadvantages of organic farming

Organic farming is the future of sustainable agriculture, offering chemical-free...

Read MoreTop Reference:

NABARD Dairy Schemes Portal

https://www.nabard.org/content.aspx?id=658

Official guidelines for DEDS, DIDF & other dairy schemesDairy Entrepreneurship Development Scheme (DEDS) PDF

https://www.nabard.org/auth/writereaddata/tender/1608180427DEDS-Operational-Guidelines.pdf

2024-25 operational guidelinesMinistry of Fisheries, Animal Husbandry & Dairying

https://dahd.nic.in/schemes/programmes-development-dairy-sector

Central government subsidy policies

Bank-Specific Resources

SBI Dairy Farming Loan

https://www.sbi.co.in/web/agriculture-banking/schemes/dairy-scheme

NABARD-refinanced loansPNB Kisan Credit for Dairy

https://www.pnbindia.in/agriculture-loans.html

Supplementary References

National Dairy Development Board (NDDB)

https://www.nddb.coop/services/financial-support

Technical project report formatsPM Matsya Sampada Yojana (DIDF Updates)

https://pmmsy.dof.gov.in/